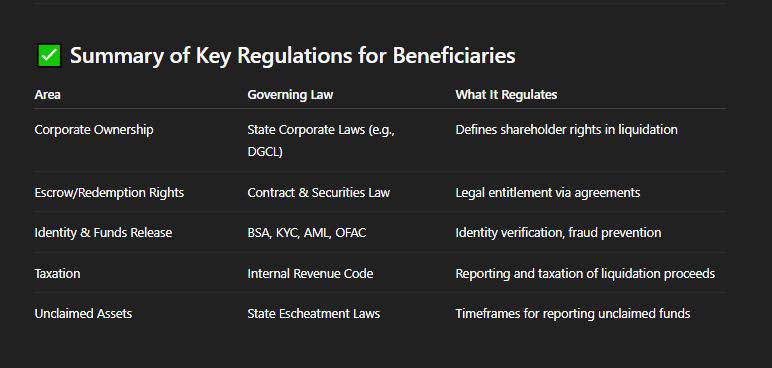

Contract Law (Stock Redemption & Escrow Agreements)

If a beneficiary is named in an agreement (e.g., a stockholder with rights to funds via redemption), they are governed by the terms of that contract.

Stock Redemption Agreement: Names the shareholder as a redeeming beneficiary.

Escrow Agreement: Establishes legal rights to funds under specific conditions.

Beneficiaries must:

Sign required agreements

Complete KYC/AML

Prove legal claim (e.g., stock certificate, transfer records)

3️⃣ Bank Secrecy Act (BSA) & USA PATRIOT Act

Regulates identity verification of beneficiaries receiving money through financial institutions or escrow agents.

KYC (Know Your Customer)

AML (Anti-Money Laundering)

OFAC screening (must not be on U.S. sanctions list)

✅ Required for all fund recipients:

Government-issued photo ID

Proof of address

Source-of-funds or entitlement verification

Internal Revenue Code (IRC) – Taxation of Beneficiaries

Determines how proceeds are taxed when paid out to beneficiaries.

IRC Section 331 – Shareholder liquidating distributions

IRC Section 6043 – IRS notification of corporate liquidation

Form 1099-DIV or 1099-B – Issued to beneficiaries for tax reporting

✅ If the beneficiary is a shareholder:

Payment is usually treated as a capital gain, not ordinary income

Tax documentation must be provided at year-end

3️⃣ Bank Secrecy Act (BSA) & USA PATRIOT Act

Regulates identity verification of beneficiaries receiving money through financial institutions or escrow agents.

KYC (Know Your Customer)

AML (Anti-Money Laundering)

OFAC screening (must not be on U.S. sanctions list)

✅ Required for all fund recipients:

Government-issued photo ID

Proof of address

Source-of-funds or entitlement verification

In What Order Are Parties Compensated During a Corporate Liquidation?

When a company undergoes voluntary or involuntary liquidation, the order in which parties are compensated is governed by corporate law and insolvency regulations. The purpose of this structure is to ensure a fair and legally compliant distribution of the company’s remaining assets.

This priority list applies to most U.S. jurisdictions and aligns with both state corporate laws (e.g., Delaware General Corporation Law) and federal bankruptcy principles (under Title 11 of the U.S. Code).

Regulation

Ensuring compliance in public liquidation processes.

Compliance

Liquidation

© 2025. All rights reserved.The Federal Government of the United States of America. CIK:0000024179

Tel: + 1 202 773 7237

Email: contact@gov.usstla.site