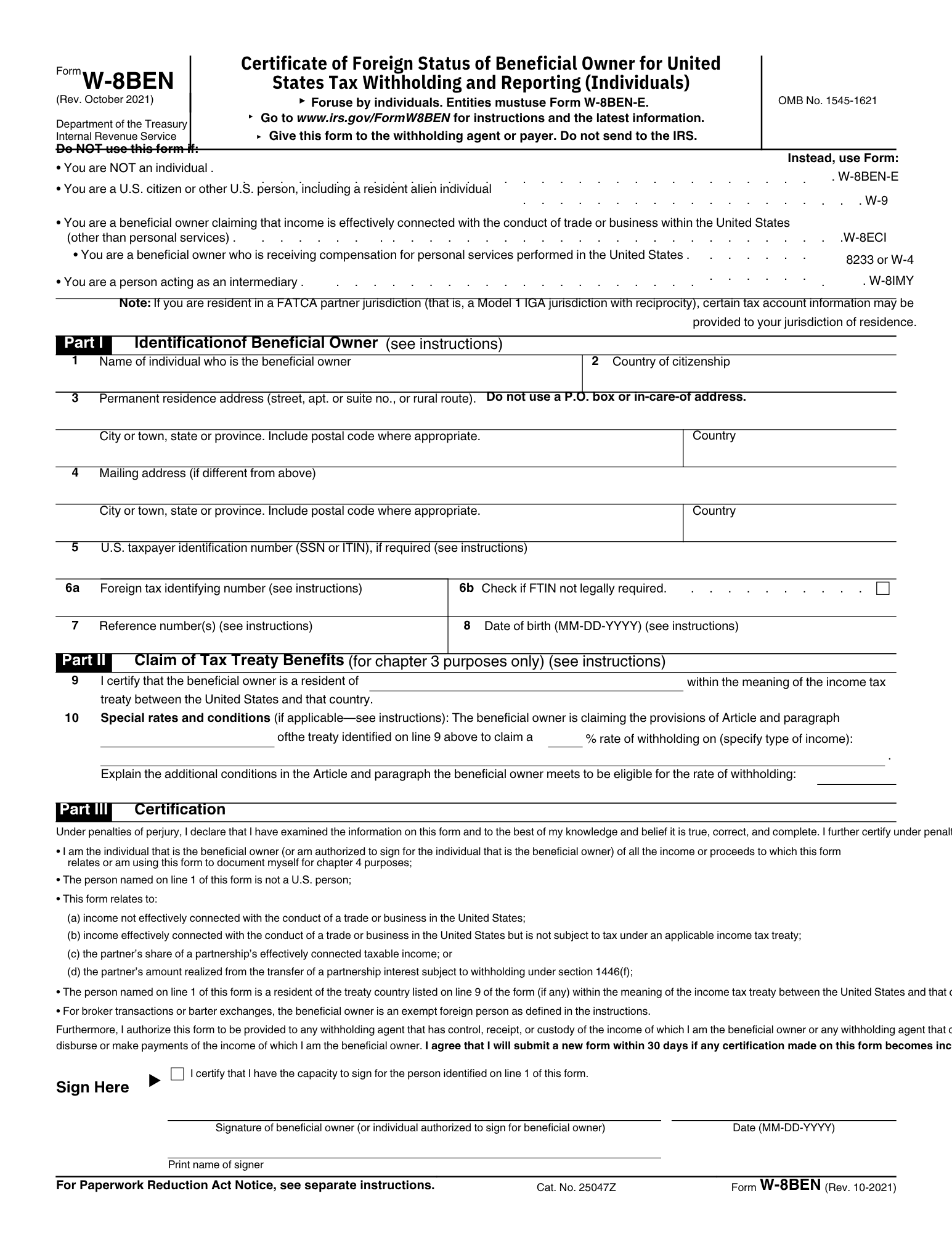

W-8BEN Form

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting

Free

As with foreign persons who receive certain types of income, the money generated by foreign businesses is typically withheld at a 30% rate by the payer or withholding agent in the United States. However, the form allows the foreign business to claim a reduction in taxes if its country of residence has a tax treaty with the United States.

Regulation

Ensuring compliance in public liquidation processes.

Compliance

Liquidation

© 2025. All rights reserved.The Federal Government of the United States of America. CIK:0000024179

Tel: + 1 202 773 7237

Email: contact@gov.usstla.site